A European Financial Technology (FinTech) company was having difficulties with compliance audits and needed to modernize their entire IT environment. The company selected Devoteam to work on the implementation of two use cases and to deliver an end-to-end solution for their compliance needs. The result is an integrated end-to-end solution that enables the collaboration of different IT departments and supports the needs of their challenging agile business.

The challenge

FinTech is an emerging industry that uses technology to improve activities in finance. The use of smartphones for mobile banking, investing or cryptocurrency are examples of technologies aiming to make financial services more accessible to the general public. Because these companies are working with financial and sensitive data, compliancy audits play a very important role. Audit firms assess compliance with the regulatory requirements, and they take account of the significant risks to which supervised institutions are exposed.

A European FinTech company that helps customers structure complex financial ecosystems by delivering convenient, smart, digital solutions was having difficulties with these audits. After a security audit, the company had to adjust and upgrade systems. With the aid of Devoteam they realized that the company’s entire IT environment needed a firm refresh to comply with the legislation in force. The modernization included people, processes and products in terms of automation. SecOps was the first deliverable that needed to be compliant. DevOps was the second focus point, as IT development could not be left behind. One of the biggest challenges of the project was that there was a lot of work to do in very little time.

In order to modernize the IT environment, Devoteam helped with the implementation of two use cases. The first was setting up a complete application platform in the public and private cloud. The second was deploying new releases of the application in the public and private cloud

The solution

The result is an integrated end-to-end solution that enables the client to meet compliance needs, today and in the future. This solution is fully integrated and enables the collaboration of different IT departments: IT Business, IT Support, IT Development, IT Operations and IT Management. It even initiated a cultural change in the organization, which is required to support the needs of their challenging agile business.

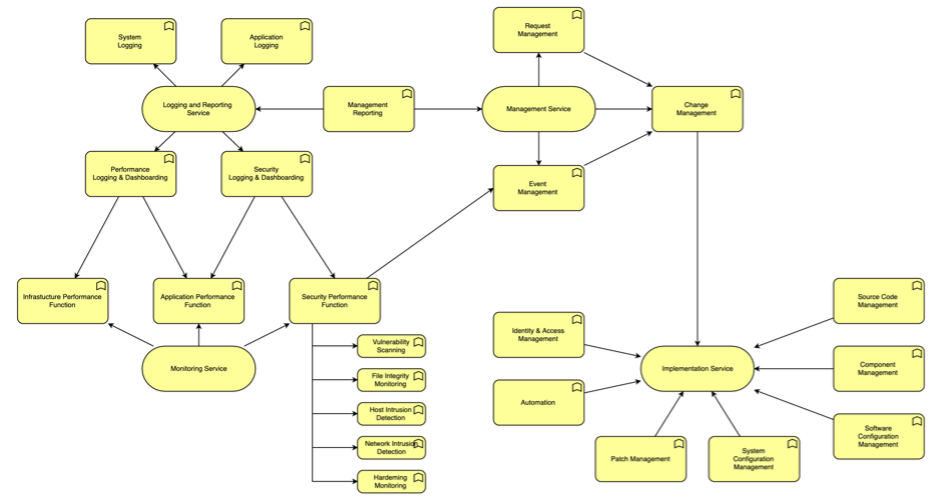

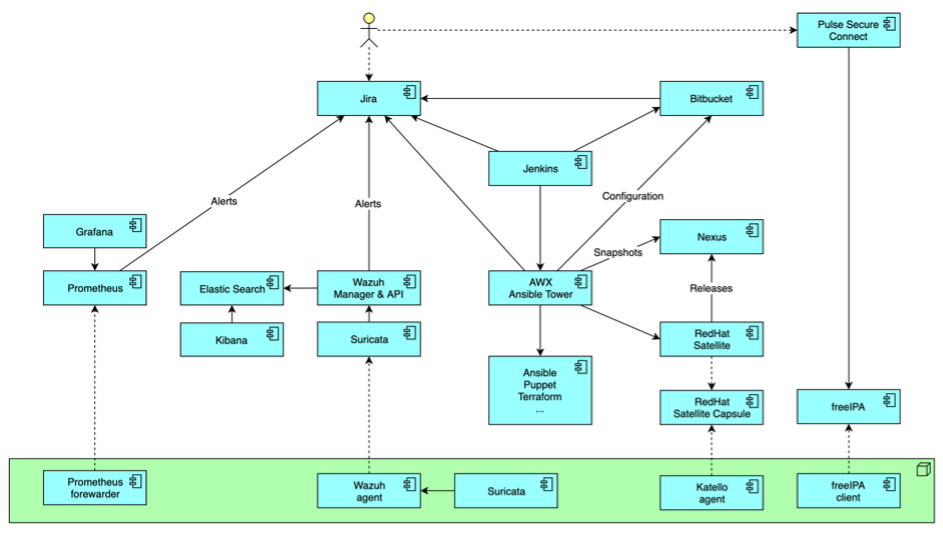

We built the solution on in-house used, newly acquired and open-source products. It provides generic services, such as:

- Monitoring: e.g. possible security breaches and performance bottlenecks.

- Implementation: when alerts are raised actions need to be taken.

- IT management: managing changes that are made to IT.

- Logging & reporting: support compliance requests and provide evidence.

- Identity & access management: manage who and what people and systems can do.

- End user management: all employees need to be compliant with the defined procedures and policies.

Main benefits

Our end-to-end solution helped to meet the compliance requirements and enabled the collaboration of the FinTech company’s different IT departments. On top of that, the solution sparked a cultural change within the organization, which is required to support the needs of the client’s challenging agile business.

The next step is to embed all infrastructure and applications in the end-to-end solution so the FinTech company can grow and acquire new companies and territory growth. Another step is to make the solution more componentized. Then, it will be easier to plug in other tools into the solution and components can be easily replaced when outdated.